Amazon Reviews

Konrad Bobilak has featured in:

Best Selling Book On Amazon

Top 10 In The Category of Real Estate Investments

Konrad Bobilak is helping thousands of everyday hard working Australians to move closer to their goal of

True Financial Independence

Dear Friend,

If you’re someone who dreams about owning a large Residential Investment Property Portfolio, which will enable you to attain Financial Independence through property investing then this will very well be the most important letter that you’ll ever read!

I know that you may be sceptical about this claim, and if you’re anything like me, chances are, you’re the person who scratches their head in frustration and wonders how other people seem to make a fortune in the property market, when you’re left out in no man’s land floundering… and that’s why this will be the most important letter you’ll ever read, that will enable you to take advantage of a very unique opportunity! You’re about to discover a book ‘Australian Property Finance Made Simple’ that can teach you a…

Proven Step-By-Step

Real-Estate Investing System

…that is easy to follow and makes so much sense. I promise you that by the end of reading this letter you’ll be wondering why nobody has told you about it before.

In-fact, you’ll be mad at everyone around you that has been putting doubts into your mind about the possibility of you owning a substantial residential property portfolio, – I know, like you, I have been there myself.

If you’ve ever felt ‘overwhelmed’ or ‘stressed out’ with the seemingly insurmountable task of living your life…just getting by day-to-day without any hope of stopping work before you’re completely stuffed and old…with no energy or money left over to enjoy a happy, stress free, successful life; to travel, to faraway places, to give to your favourite charity whenever you like or simply have the time and financial freedom to do whatever you darn well like… then this book was written just for you!

Here Is The Interesting Thing About Property Investing In Australia

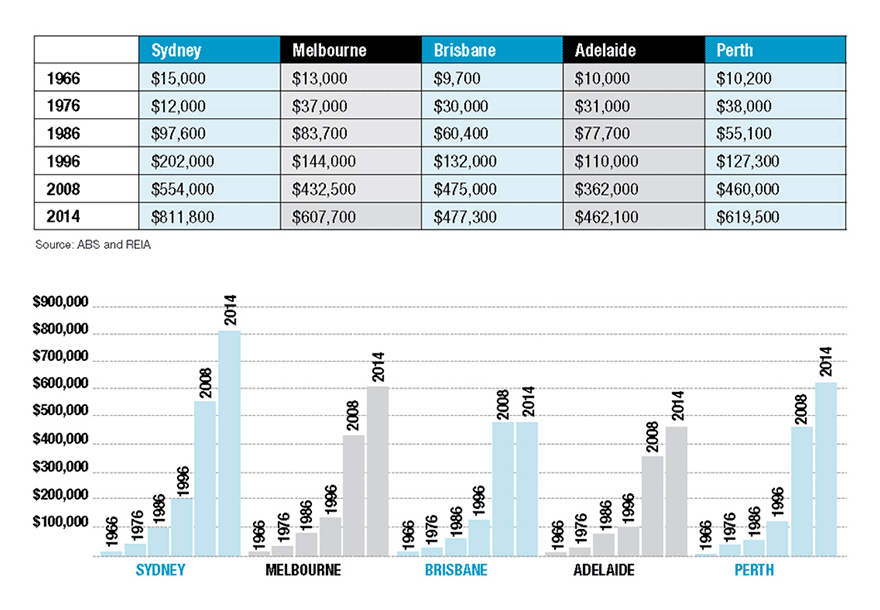

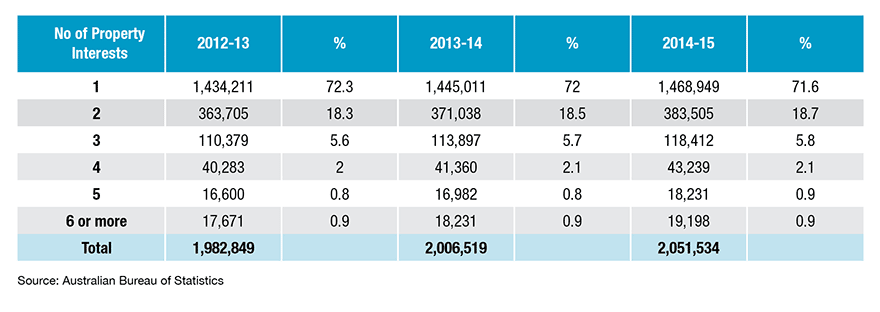

The latest figures from the Australian Bureau of Statistics (ABS) show that:

- 71.6% of Australian property investors own just 1 investment property 71.6%

- 18.7% Of Australian property investors own exactly 2 investment properties 18.7%

- Less than 1% of property investors in Australia own 6 investment properties 1%

Only 1 percent of the entire pool of property investors own more than 6 investment properties…

The problem is that no one is really teaching the topic of financial literacy specifically when it comes to residential property investing, and more specifically, no one is teaching the specific methods that are used by sophisticated property investors on how to build and structure their multi-million dollar property portfolios…

Until now…

So let me ask you something…

Would you like to learn what only the 1 per cent of property investors in Australia know and practice…

If your answer is a resounding ‘Yes’, then order your copy of the book ‘Australian Property Finance Made Simple’ NOW!

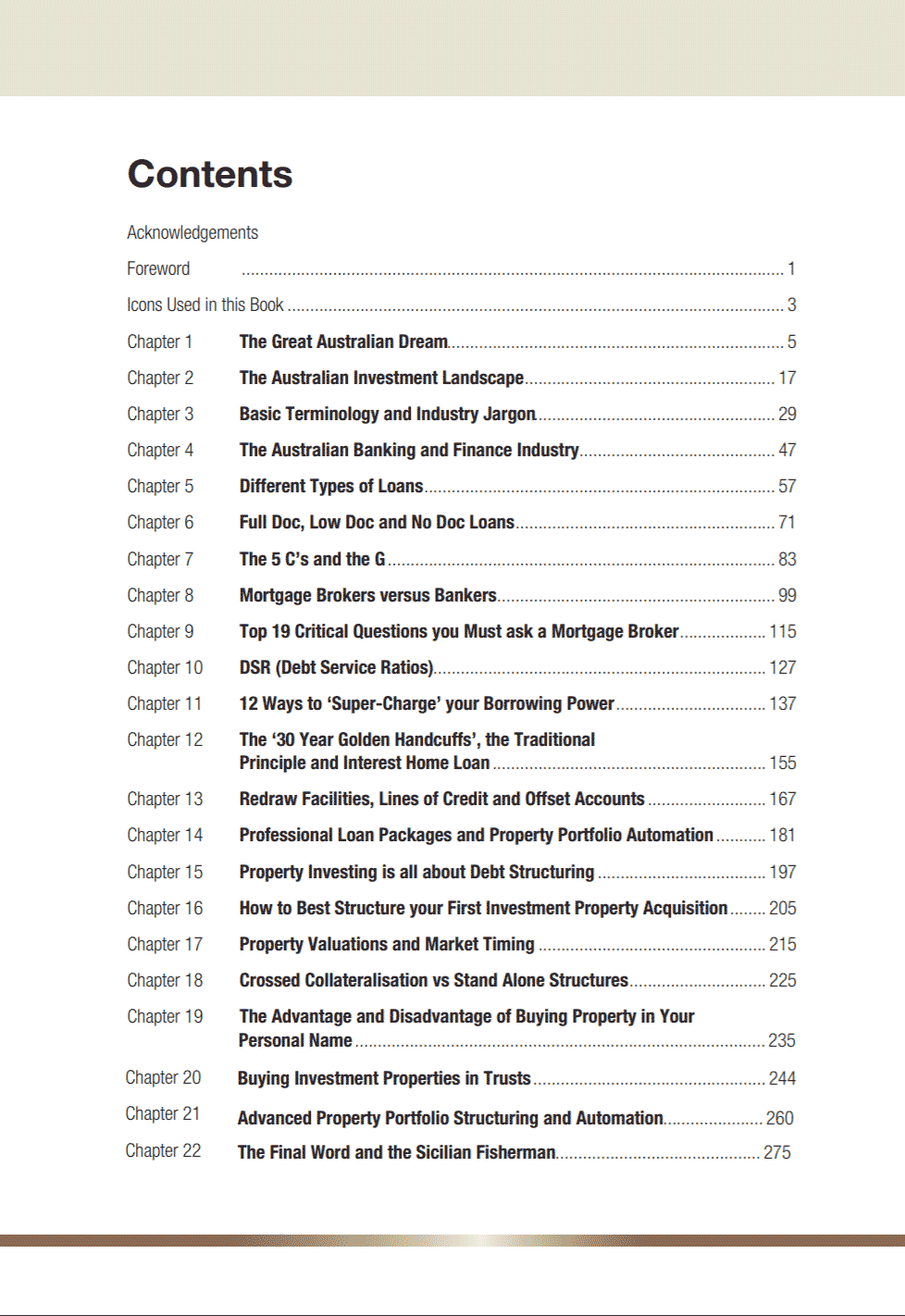

So What’s In The Book,

Well Here Are The Actual Chapters…

Download and Read 3 Chapters From the Book ‘Australian Property Finance Made Simple’ For Free!

Receive 3 FREE chapters from

‘Australian Property Finance Made Simple’.

Chapter 11: 12 Ways to ‘Super-charge’ Your Borrowing Power.

Chapter 16: How To Best Structure Your First Investment Property Acquisition.

Chapter 19: The Advantages And Disadvantages Of Buying Your Next Investment Property In A Trust Or Your Own Personal Name…That Every Investors Needs To Know About!

3 Very Important Aspects Of This Book, Which Makes It An Essential Learning Tool For Anyone With A Home Loan, Or An Investment Property.

That’s why Chapters 3, 4, 5, 6, 7 , 8, and 9 are dedicated to give you a thorough understanding of the lending industry, the key players, as well as clarification of ‘industry jargon’… and believe me there is a lot of unnecessary ‘industry jargon’ used in finance and lending.

Bottom line, I wrote the book for laymen – NOT industry insiders.

That’s what Chapters 10, 11, 12, 13, 14, 15, 16, 17, and 18 are all about.

So whether you’re a first home buyer, first time investor, or a seasoned pro, you will be blown away with the contents that I have assembled in this book!

And this brings us to an important analogy…

Building A Large Property Is Just Like Baking A Cake; You Need The Right Ingredients, Add Them In The Correct Sequence, And Must Follow The Recipe…

It seems crazy? Doesn’t it?

Many sophisticated investors and experts believe the missing ingredient that separates the 1 percent from the rest is financial literacy.

The problem is that no one is really teaching the topic of financial literacy specifically when it comes to residential property investing.

And more specifically, no one is teaching the methods that are used by sophisticated property investors on how to build and structure their multi-million dollar property portfolios…

Until now…

So Why Should You Listen To Me?

- Bachelor Of Business Management, Monash University, B.Bus (Mgt),

- Diploma of Financial Services (Financial Planning) FNS50804,

- Certificate IV in Property Services (Real Estate) CPP40307,

- Certificate IV in Financial Services (Mortgage Broking) FNS40804.

I became passionate (on the obsessive side) in real estate investing some 20 years ago, at the age of 18, and ever since I caught the property investing bug I have strategically worked in a variety of industries that allowed me to gain a real insider’s perspective on how successful property investors in Australia really made money from investing in property.

Along the way I completed a Bachelor of Business Management (B.Bus.Mgt), at Monash University, specialising in Organizational Change, later undertaking further studies in Financial Planning, Mortgage Brokering eventually my ultimate passion, Real Estate.

In addition, I have had extensive experience in Managed Funds, Risk Insurance, Real Estate Sales, Commercial Lending, Residential Lending, and Asset Finance, as well as being a Financier for one of the four major banks.

In my varied roles, working predominantly with high net worth individuals, I have literally had a wealth of exposure to the unique mindset and financial structures of truly successful people and investors.

The objective of all my roles in the various industries that I worked in for the past 20 years or so was twofold;

- Get to understand why certain people succeed in real estate investing and why others fail.

- To get to work personally with people who are successful property investors, and here I am talking about the 1 per cent of the very best in the country.

And guess what, it worked…

And a cool thing happened along the way…

My unique insights into ‘Wealth Psychology’ combined with a highly specialised knowledge of the Finance and the Real Estate Industry in Australia, made me a sought after Real Estate and Finance ‘Key Note’ speaker and successful real estate investor.

Over the last 6 years I have had the privilege of having taught tens of thousands of people in Australia, New Zealand and Fiji, as well having the unique opportunity of sharing the stage with the likes of Sir Richard Branson, Tim Ferris, and Randi Zuckerberg in audiences of up to five thousand people.

But here is the real kicker…

The number 1 reason of why you should listen to me, is that beyond all my credentials and real hands-on-industry experience… I have achieved considerable results as a property investor myself.

Hence, the book ‘Australian Property Finance Made Simple’ has been written by a property investor for property investors.

And That’s Very Important For You To Understand… This Book Is Not Written By And Academic… It’s Been Written By Someone That Has Done It

But enough about me, let’s get back to you…

Whilst a small percentage of the Australian population has managed to increase their wealth thorough property investing, very few are actually maximizing their returns and fewer still have worked out how to best optimize their financial structures.

Whether or not you are aware of this, this is costing you money, and more importantly the opportunity cost of time, and missing out on the potential of paying off your (non-tax deductible ‘bad debt’) home loan sooner, as well as missing out on accumulating more investment properties (tax deductable ‘good debt’) in your property portfolio.

And Here Is The Harsh Reality…

From my personal experience and observations working in the Mortgage Broking and banking industries, most property investors settle for under-performing property portfolios as well as unsuitable loan structures that are robbing them of thousands of dollars per year…

The Good News Is That You Don’t Have To Be One Of Those People

And that’s the reason why I wrote this book… this was my number 1 objective. You see, whilst there is a plethora of information out there on how to find the best performing suburbs and properties, and about market timing, etc., very few companies and/or individuals are teaching the fundamentals behind how to best structure a large property portfolio, from purely a finance perspective.

That’s where the ‘Australian Property Finance Made Simple’ comes in…

And It’s One Of The Most Important Things That I Learnt By Working With High Net Worth Individuals

The biggest misconception held by novice property investors, and the public at large, is that the ‘rich’ (in this case wealthy and successful property investors) do ‘certain things’ that the poor and the middle class are not aware of, or don’t have access to…

A lot of people think that the rich have access to ‘special private bankers’ that can access products or loans that are not being offered to the general public… I used to think that way as well…

But then after spending years working as a Mortgage Broker, and a financier for one of the four major banks, I found this only partially true… The reality is that the ‘rich’ (in this case wealthy and successful property investors) don’t do ‘certain things’, they do ‘things in a certain way’… And that makes all the difference…

Clear as mud?

Ok, so when it comes to building wealth though property investing, the most successful property investors actually have access to the very same lending products that are accessible to the general public…

Sure, they might get a bigger discount off the interest rate, and have access to a private banker, but the products are essentially the very same ones that you and I can access…

But that’s not where the difference is, it’s the way they structure those loans, that makes the difference… and that’s the ‘secret recipe’ that has eluded most property investors for eons… Until now…

The ‘Australian Property Finance Made Simple’ book reveals the ‘secret recipe’ on how to correctly structure your finances with the objective of maximising leverage, tax efficiency, whilst focusing on buying more investment properties and simultaneously paying off your home loan in record time.

This book provides the reader a real ‘insider guide’ into the lending world, outlining the key players in the mortgage and banking industry, and a detailed breakdown of the main lending products available on the market today.

This book highlights in detail, the main loan structuring techniques currently used by the savviest and most successful home owners and property investors in Australia today, many of whom have paid off their homes completely in less than 10 years, whilst concurrently having built and structured multi-million dollar property portfolios.

All anecdotal scenarios and recommendations that are made throughout this book are drawn from years of real experience working at a very high level in the banking and mortgage broking industries, as well as having personally applied the very same loan structures myself.

So, this book is relevant To you if you happen to fall into any of the following 4 categories;

You are a first home buyer wanting to understand the very best loans that are available for you and how to best structure your finances in order to repay your home in record time, often in under 10 years.

By reading this book, you will learn why it’s crucial to set up the correct loan structures before you buy your very first investment property, and how you can beat the banks at their own game in order to reduce the amount of interest that is being charged on your home loan.

This will cut years off your home loan and save you tens of thousands of dollars in interest payments over the life of the loan. You will also learn how to build equity in your property faster than you thought possible, and how to best structure your first investment property purchase correctly.

You are an aspiring property investor wanting to buy your very first investment property, and are unsure on how to best structure your loans.

By reading this book, you will learn the best way to optimise your property portfolio structure from day one, revealing many little known loan structuring techniques that maximise your borrowing capacity, whilst maximising flexibility, future access to equity, as well as being tax effective and minimising risk.

By reading this book, you will learn how to beat the banks at their own game by understanding the ‘exact formulas’ that the banks use to work out how much money you can borrow, the Debt Servicing Ratio (DSR)

You are an established property investor and have realised that you have made some fundamental mistakes in the way that you’ve structured your property portfolio due to some ‘bad advice’.

If something has held you back from aggressively acquiring more property, such as allowing lenders to ‘crossed collateralise’ your property portfolio, or you have an impaired credit file, have an irregular stream of income, or are simply using antiquated Principal and Interest Loans (P&I), you must read this.

But if that’s not enough…

Here is just a snapshot of some of the key distinctions that you will learn by reading ‘Australian Property Finance Made Simple’;

You will learn a ‘proven method’ of how to pay off your current 30 year Principal and Interest Mortgage in 10 years or less without making any additional payments, saving yourself tens of thousands of unnecessary interest repayments and years off your mortgage.

You will learn how to best structure your first investment property acquisition, whereby you are maximising your tax deductions, and tapping into the power of leverage.

Finally, the main reason I wrote this book is to equip the average Australian with enough financial intelligence to tackle what is perhaps the single biggest financial commitment of their life… their ‘mortgage’.

This book is designed as a practical reference guide that will empower readers’ thoughts and illustrate why the ‘traditional’ home and investment loans are completely outdated and will take the average person decades to pay off, and how the banks have created this system that keeps them rich at the expense of the average Australian.

More importantly, this book will give you a step-by-step blue-print on how to pay off your home sooner than you could have ever imagined, and how you can place yourself a financial position sooner, where you can start building wealth though acquiring a property portfolio!

So, don’t wait a minute longer!

You cannot afford to!

Order your copy of ‘Australian Property Finance Made Simple’ book below;

- 50%

Receive 3 FREE chapters from ‘Australian Property Finance Made Simple’.

Simply, fill in the form for immediate access!

100% guaranteed privacy. We don’t spam. Ever!

- 50%

Get expert property investing tips and free resources straight to you inbox!

Enter your details below to subscribe.